Impact on Construction and Infrastructure Projects during Post-COVID Recovery

As industries continue to adjust to these supply chain issues and ramp up production during the post-COVID recovery, demand for metal products, including geogrid, will likely increase. Geogrid is a type of geosynthetic material commonly used in civil engineering and construction projects to reinforce soil and provide stability.

Add a focus on building clean technology for renewable energy and a renewed focus on infrastructure in the United States and China, and you have the perfect storm for high metal prices, including those used in geogrid production.

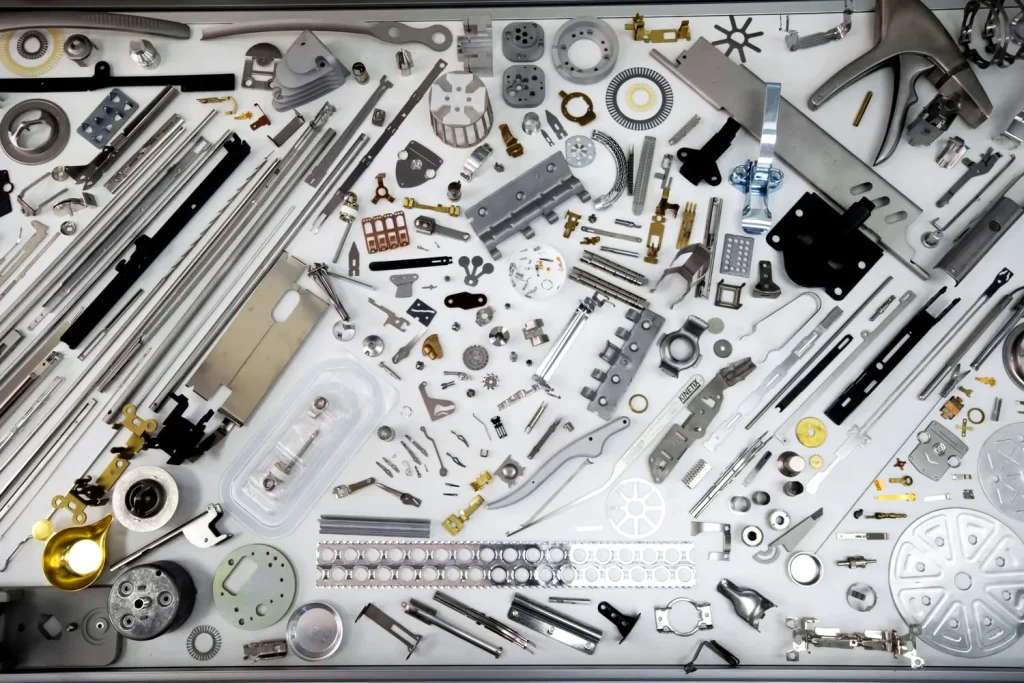

Which metals are affected?

While supply shortages and high demand are affecting almost every metal market, the metals most frequently used in industrial production, including geogrid, are the most affected. Manufacturers can expect to see increases in steel, aluminum, copper, nickel, and other metals used in geogrid manufacturing.

Steel & Stainless: Consolidation and reshoring of steel operations, along with reduced steel scrap, means higher costs for steel refinement and production, impacting geogrid manufacturing.

Aluminum: Canada, the primary supplier of aluminum for U.S. operations, has established quotas on the amount of aluminum exported to our shores. So far, our aluminum demand far exceeds this limitation—and less availability equals higher prices, affecting geogrid production.

Copper: Copper is critical for electronics and electrical components, including those used in renewable energy and infrastructure projects. Supply shortages and increased demand for electric cars, infrastructure, microchips, renewable energy, and energy storage are keeping prices high, impacting geogrid manufacturing.

When will the price go down?

While record-high metal prices, including those used in geogrid production, are forecasted to drop as the global economy continues to recover, they are unlikely to return to pre-pandemic prices in the near future. The market may still remain tight into 2022 as large-scale infrastructure plans in the U.S. and China, including geogrid-intensive projects, keep demand for these metals high.

The pandemic is causing more than a price impact, as shipping challenges may result in lengthier lead times for some materials, including those used in geogrid production. Because supply is tight, we recommend adding several months or more to your production lead times in 2022 to account for potential delays and ensure a steady supply of geogrid and other metal products.